schedule c tax form h&r block

However H R Block does. Its part of the individual tax return IRS form 1040.

H R Block Tax Software Premium 2021 Digital Code By Mail 5 Users Walmart Com

Long story short the profit or loss you.

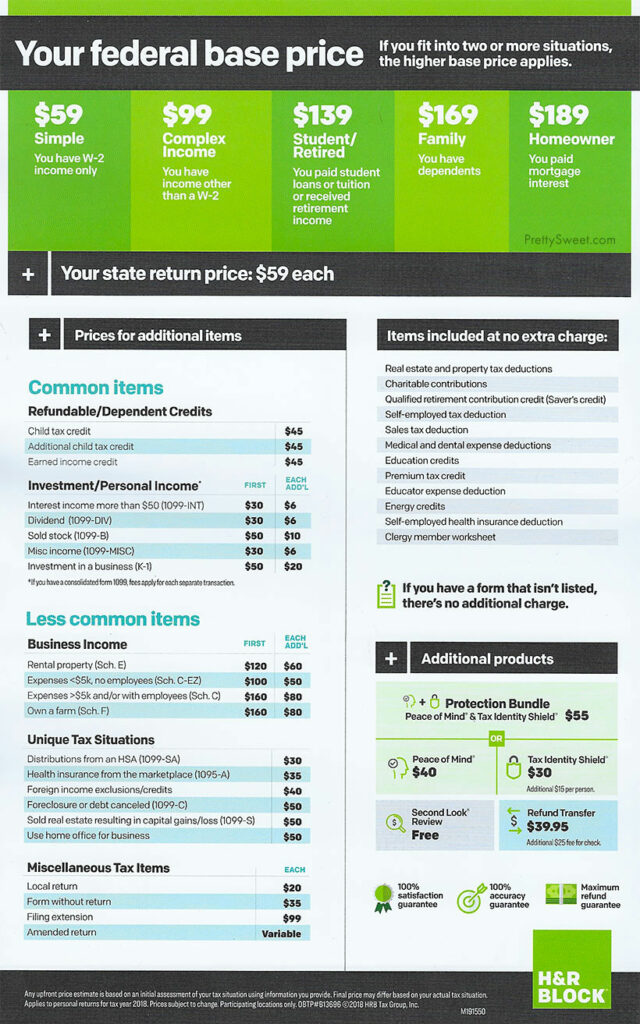

. However if you were to add itemized deductions and a Schedule C with business income then this fee could easily double or even triple. You can also file some additional schedules and forms with this option. And Capital Gain Tax Worksheet the Schedule D Tax Worksheet Schedule J Form 8615 or the Foreign Earned Income Tax Worksheet enter the amount from that form or worksheet in.

Its an excellent choice. Schedule C is a tax form used by most unincorporated sole proprietors to report their business income and expenses. I know I need Form 1120-H federal form but am not sure which form for state of Oregon.

For a December 31 year-end the due date is March 15. Whether your business has a profit loss or gain The form is part of your personal tax returnSchedule C is typically filed with Form 1040. Plan on spending a certain amount per.

A simple tax return excludes self-employment income Schedule C capital gains and losses Schedule D rental and royalty income Schedule E farm income Schedule F. To be a qualifying child for the child tax credit the child must be your dependent under age 17 at the end of 2020 and meet all the conditions in Steps 1 through 3 in the instructions for line 19. Health insurance Up to 100 deduction for your qualified premiums Forms 1099 for gig workers and Schedule C Your 1099 gig worker forms and Schedule C are used to report your income to.

Net profit from the activity is subject to the 153 self-employment tax you report on Schedule SE which functions in a. Schedule C is a tax form for small business owners who are either a sole proprietor or have a single-member LLC. There are 4 online versions to choose from.

But there are exceptions to paying taxes. Enter your name and Social Security number. If youre a resident of Québec and youve incurred childcare expenses during the year youll need to complete and submit Schedule C.

When entering your business expenses HR Block automatically categorizes them and places them. With HR Block online software youre going to be able to claim every credit and deduction available to you. When it is taxable nonbusiness debt youll use the copy of the 1099-C to use to report it on Schedule 1 of Form 1040 as other income.

Top of the form. Optional methods to figure net. Schedule C details all.

SCHEDULE C Form 1040 or 1040-SR Department of the Treasury Internal Revenue Service 99 Profit or Loss From Business Sole Proprietorship Go to wwwirsgovScheduleC for. The form is titled Profit or Loss from Business Sole. HR Block gives taxpayers comprehensive easy-to-use tax software for documenting relevant income deductions and credits on their 1040s.

Information about Schedule C Form 1040 Profit or Loss from Business used to report income or loss from a business operated or profession practiced as a sole proprietor. SCHEDULE C Form 1040 Department of the Treasury Internal Revenue Service 99 Profit or Loss From Business Sole Proprietorship Go to wwwirsgovScheduleC for instructions and. Basic Best for simple tax.

Schedule C is used to report your net income from self-employment. Heres a summary of how to fill out Schedule SE. I was told by H R Block I needed Schedule C but the President of the Association thinks that is.

The Form 1065 is due on the 15th day of the 3rd month after the end of the partnerships tax year. HR Block offers easy access to common deductions that you may overlook. Tax credit for childcare expenses with your Québec return.

As mentioned both services offer a free option covering simple returns.

H R Block Taxcut Premium Federal And State Software 1016600 06

H R Block Review 2020 Free Online Tax Filing Software Pros Cons

The Best Free Tax Software H R Block Taxslayer And More

Best H R Block Pricing Online Download State Fees 2022

H R Block Onine Review Tax Prep Software For Every Situation

How To Fill Out A W 4 Form H R Block

H R Block Review 2022 Make Tax Preparation Easy

Tax Support Online Tax Software Product Support H R Block

H R Block Tax Software 2019 On Sale Now H R Block Newsroom

H R Block Reports Growth In U S Tax Returns H R Block Newsroom

Best Buy H R Block Tax Software Premium Business 2020 Digital 1116800 20

What Is A Schedule C Tax Form H R Block

Capital One And H R Block Tax Offer Is It Worth It Money Under 30

Online Tax Assistance H R Block